Senior Life Insurance Company is not a pyramid scheme. The confusion often comes from distinguishing between legitimate businesses and illegal schemes. Pyramid schemes make money from recruiting new members, whereas Senior Life Insurance Company makes money by selling life insurance policies to seniors.

With 50 years in the market, Senior Life Insurance Company has built a reputable presence. Customer reviews are mixed, reflecting both satisfaction and dissatisfaction, which is common in the insurance industry. It’s important for consumers to thoroughly research before making decisions.

Concerns about the company’s legitimacy usually arise due to its hierarchical structure, which is typical of many businesses. Unlike multi-level marketing schemes, Senior Life Insurance Company operates transparently with clearly defined products and services.

History and Background

Established several decades ago, Senior Life Insurance Company boasts a strong presence in the insurance sector with approximately half a century of experience. Despite not being accredited by the Better Business Bureau (BBB), the company has managed to earn a high BBB rating.

However, it has faced criticism over numerous complaints, which raises questions about its customer service and operational practices. The high complaint index, averaging 3.67 over three years, is notably significant as it is almost five times the expected complaint rate.

Products and Services Offered

Senior Life Insurance Company primarily focuses on final-expense life insurance, aimed at helping seniors manage end-of-life expenses such as funeral and burial costs. They work in collaboration with Ethos, an online company, to provide their insurance products.

Despite their efforts to offer reliable and affordable insurance coverage, their prices are above the industry average, and customers frequently report receiving unsolicited calls. These factors are crucial for potential clients to consider when evaluating whether to engage with their services.

Analyzing the Business Model

Revenue Generation

Senior Life Insurance Company earns its revenue by selling life insurance policies targeted at seniors aged 50 and above. The policies cater to the specific needs of the elderly, including funeral expenses and medical costs.

Unlike pyramid schemes that rely on continuous member recruitment for income, this company profits directly from the premiums paid by policyholders. Their strong market presence, built over several decades, further validates their legitimate status as an insurance provider.

Recruitment Practices

The recruitment processes at Senior Life Insurance Company focus on hiring qualified agents to sell insurance policies. They do not make income primarily through recruiting new members. Agents are compensated based on policy sales rather than bringing in new recruits.

This is in stark contrast to pyramid schemes, which typically reward participants for continuously expanding their network. The company’s focus remains on policy sales and customer satisfaction, not on expanding its agent base through recruitment incentives.

Comparison With Pyramid Scheme Traits

Pyramid schemes are illegal and unsustainable business models that thrive on recruiting new members to generate profit. In contrast, Senior Life Insurance Company derives profits from selling tangible insurance products.

There is no dependence on new member fees for earnings. Further, the business model does not exhibit the classic red flags associated with pyramid schemes, such as requiring large upfront investments from recruits or promising guaranteed returns solely based on recruitment.

Public Perception and Reviews

Customer Testimonials

Customer testimonials for Senior Life Insurance Company are mixed. Positive reviews often mention the company’s willingness to assist and the friendly nature of its customer service representatives. Some customers appreciated the ease of setting up their insurance plans and found the company reliable in processing claims efficiently.

On the contrary, numerous negative reviews can be found online. A significant number of customers express dissatisfaction, reporting delays in claim settlements and inadequate support.

Comments describe the company as an MLM insurance company with numerous unresolved complaints and accusations of mishandling policies. The Better Business Bureau’s non-accreditation of the company also fuels skepticism.

Expert Analysis

Expert analysis of Senior Life Insurance Company tends to be critical. Despite the company having 50 years of experience and a high rating through the BBB, they are not BBB accredited and have numerous complaints.

Experts highlight the similarities between the company’s business model and that of pyramid schemes. Such schemes promise high returns for minimal investment but are fundamentally unsustainable, relying on continuous recruitment rather than genuine product sales.

Analysis indicates that consumers should approach with caution, given the rising concerns about the legitimacy and operational transparency of Senior Life Insurance Company.

Bottom Line

Senior Life Insurance Company has 50 years of experience in the life insurance industry. This extensive history contributes to its credibility and reputation.

In the U.S., individuals typically qualify as senior citizens at age 65, a demographic the company serves with tailored insurance solutions.

The company’s high rating through the BBB indicates trustworthiness, although it is not BBB accredited. This detail is notable considering the numerous complaints received.

A significant factor is the mixed customer feedback. While some reviews are positive, others highlight potential issues, such as unsolicited calls and dissatisfaction with pricing.

No medical exam is required for policy approval, which can be advantageous for seniors looking for hassle-free options. Coverage options also aim to address final expenses, typically ranging from $5,000 to $50,000.

Related Posts:

- How to Identify If North American Senior Benefits Is…

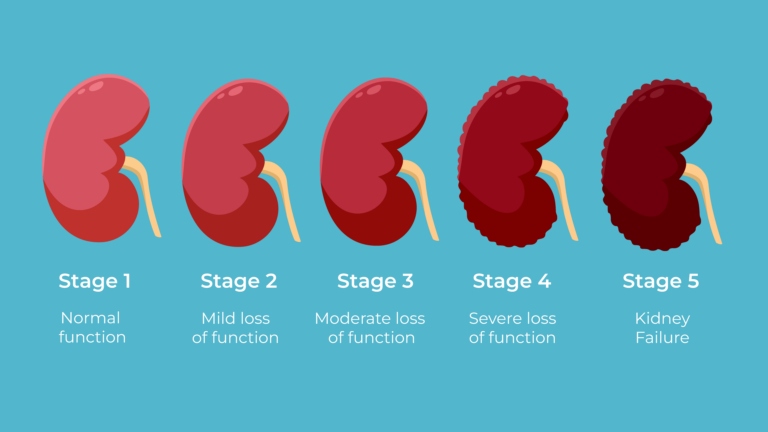

- COPD Life Expectancy - What Each of the 4 Stages Means?

- The 5 Stages of Kidney Disease and What They Mean…

- What Services Are Included in Verizon’s Senior Plan?

- What Age Is Considered a Senior Citizen in the U.S.?…

- Top Free Transportation Options for Senior Citizens in 2024